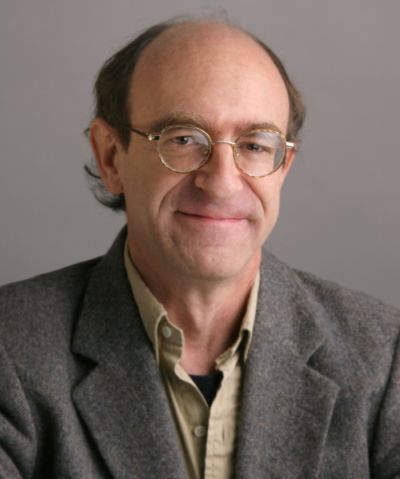

| No Human Left Behind! Seth Berner for Maine Legislature in 2012 | |||||

| Home - www.sethberner.com Biography Philosophy Endorsements Graphics Children Climate Crime Education Healthcare Human Rights Jobs People Power Taxes Water | |||||

|

|

|

169 Clinton St. | |||

| Tax Policy Did you hear the one about the Mainer who said "Maine has the highest tax rate in the country!" Boy, if I had a dollar for every time I heard that I could afford to pay my taxes. Ha ha. But this isn't funny. Not really. And it's not funny not because it's serious, it's not funny because it's wrong, and the wrong way of looking at it. I am not a Libertarian. There are some people who really do believe in shrinking government so that it is small enough to drown in a bathtub, in the famous words of Grover Norquist. Ron Paul might believe it, he is a true Libertarian. But most people who claim to be antigovernment are no more so than Norquist, who was advising presidents during the biggest deficit creation in American history. Norquist and most Tea Party members believe plenty in government. For Norquist government was military buildup and privatization of previously government-run programs, at a much greater cost to government. And if you ask the average Tea Party person if he really wants to build and maintain his own roads; to have a pig farm established on the lot next to his house because there is no zoning board to prevent it; to buy bad meat in the supermarket because there's no government agency trying to protect citizen health; to not be able to do anything about the crazy party next door at 3:00 AM; to haul his own garbage to the dump, and pay to have the dump running; to have to rely on friends if his house catches on fire; to have no government agency trying to control the free-flow of diseases he would say: of course not. The issue is not whether there should be government; the issue is what government should do and how it should be paid for. Your taxes probably are too high. For most of the time the United States has had an income tax we had what was called a graduated or escalated system, where the percentage you paid depended on what you had. The less you made the less you paid, the more you made the more you paid. This is not a revolutionary concept. To quote a great robber baron, Willie Sutton explained that he robbed banks because that's where the money is. Why should we tax those who have more? because that's where the money is. If you think this smacks of socialism and that makes you uncomfortable think about how you run your family. Mom and dad do more work than the kids because, to reduce it to Sutton-like simplicity, they can. Kids should do some work because in a family everyone should pitch in, and as they get bigger and stronger they pitch in more; but while they are too small to rob you don't treat them like pack mules because it isn't fair and the kids know it and will resent it; and it won't get your jobs done. If dad breaks a leg and can't shovel the driveway little Jimmy might have to do more, but that's not because little Jimmy should be doing the same amount normally, it's because in tough times we all chip in. Think of society as a family and it all makes sense. To look at it in another way, would it be fair to require little Jimmy to pay the same amount towards the mortgage out of what he makes delivering newspapers as father John the lawyer (I can make lawyer comments since I am one)? That is what happens when the same tax rate is assessed against all people - a 6% tax on a millionaire won't cause any particular discomfort, but a 6% tax on someone making $20,000 a year might mean literally not being able to buy a winter coat. From one point of view an uneven tax rate is not fair, since it requires some to pay more. But then it's not fair that some people can work themselves to death and have nothing to show for it while others get rich watching TV, some things just aren't fair. This had not been in serious dispute. Under Reagan, though, a new justification for flattening tax rates was put forward. The rich were allowed to keep more - that is, to pay less - on the theory that if those who control the jobs are allowed to keep more money they will be able to put more into creating new jobs, thereby helping everyone. David Stockman, who is credited with conceiving trickle-down economics for Reagan, quickly renounced the theory as unsound. But we have been flattening taxes ever since anyway. The direct result of flattening the rates everyone pays is that the comfortable, who are paying less than they used to, have been holding on to more, creating not jobs but the greatest wealth gap between the comfortable and the uncomfortable in the industrialized world. And the less comfortable are having to shoulder a bigger and bigger burden, if not directly in taxes then in having to pay for government services that used to be free. If you are lower or middle class your taxes almost certainly are too high. To put this in family terms, most of us are little Jimmy, our father a professional football player. And our father is making us do the heavy lifting of packing the books in the library and carrying them out to the moving van while he's watching TV with his feet up on the couch. You are not imagining it, you probably are paying too much in taxes. Fair taxation means fair taxation, not no taxation! The Tea Party solution is to do away with taxes altogether. That does away with services, many of which are essential to a well-organized modern society. Scratch the average Tea Party Member deep enough and that understanding is there. The answer is restoring a graduated system of taxation for the State of Maine. I don't have exact numbers. What I do have is the benefit of a number of studies that suggest that if the comfortable are taxed at a rate they can afford and the less-comfortable are taxed no more than they can afford the State gets more revenue than it is bringing in now, and fewer people are falling or being pushed between the cracks. Does Maine have the highest tax rate in the country? Let's return to this. If we look at what the average person is paying that might be so. But the cost of living is pretty high in Maine - it costs more to heat in the winter than it does in Texas, and winters are pretty long here. It costs more to buy steel here since none is made here. We have a high cost of living. With a high cost of living comes a high number of people not making it. And that means more government assistance. There is a cost associated with living in a beautiful place like Maine, and we who live here are going to have to share in it. But let's say that Bill Gates, Sam Walton, Lebron James and a few other billionaires decided to live here. And they all were "asked" to pay, say, 15% of their income in taxes each year. Trust me, none of them would starve. Since they are currently paying only around 8%, a lot more income would be flowing to Maine. In fact, depending on how the numbers actually turn out Maine likely would do very very well. Well enough that Maine could afford to also reduce or even eliminate the amount being paid by those struggling to make ends meet. In this scenario, with the total amount of taxes being paid by the same number of people staying the same or even increasing the average rate paid by each individual would remain high. But the amount paid by the middle and lower classes would actually be lower than it is now. Of course a troop of billionaires is not likely to move into Maine, putting their income subject to Maine taxation. But we do have a fair number of millionaires. And tax rates at the upper brackets when Reagan started were as high as 70%. When he finished slashing taxes upper rates were 28%. As I say, the upper rate in Maine now is around 8%. We can raise tax rates on our millionaires by a good margin before we come even close to what had been considered acceptable levels. Without having to hope for the unlikely we can generate a whole lot of revenue by taxing those who have, while lightening the burden on those who do not. The average might stay high, but the actual payments will be more fairly distributed. The question is not what our average tax rate is, the question is who is paying what. Do you want real change or just more pennies and nickels? A couple of sessions ago the Maine Legislature passed a "revolutionary" tax overhaul that flattened rates and supposedly imposed added sales taxes on tourists. Nothing necessarily wrong with taxing rich tourists. But when a tax bill does not tax golf and skiing it's pretty clear that it is not rich tourists that are being taxed - I haven't met an out-of-Stater yet who comes here in February especially to get a haircut, or in June to get his car fixed. They come here to golf and ski and they were not going to be taxed on it. And if it's not rich tourists who were going to be taxed guess who it was going to be? The flatter the tax, the greater the impact on those at the bottom. Maine saw through that swindle and voted it down by a large margin. The question is whether you want to return to office the same folks who voted it in. At the time we had a Democratically controlled House, Senate and Blaine House. This was the Democrats. Since then the Democrats have been the minority party but they have not used the power that they have to fight for real fairness. Maine needs fair taxation! Maine needs Seth Berner! | Sign Up to Volunteer | ||||

|

| |||||